Transforming DeFi with AI-Powered Cross-Chain Portfolio

Unipool is a public, decentralized pool where intelligent agents autonomously rebalance and manage crypto assets using our Smart Contract deployed on Unichain. By leveraging multi-chain liquidity, Unipool offers users a fully automated, transparent, and optimized DeFi experience..

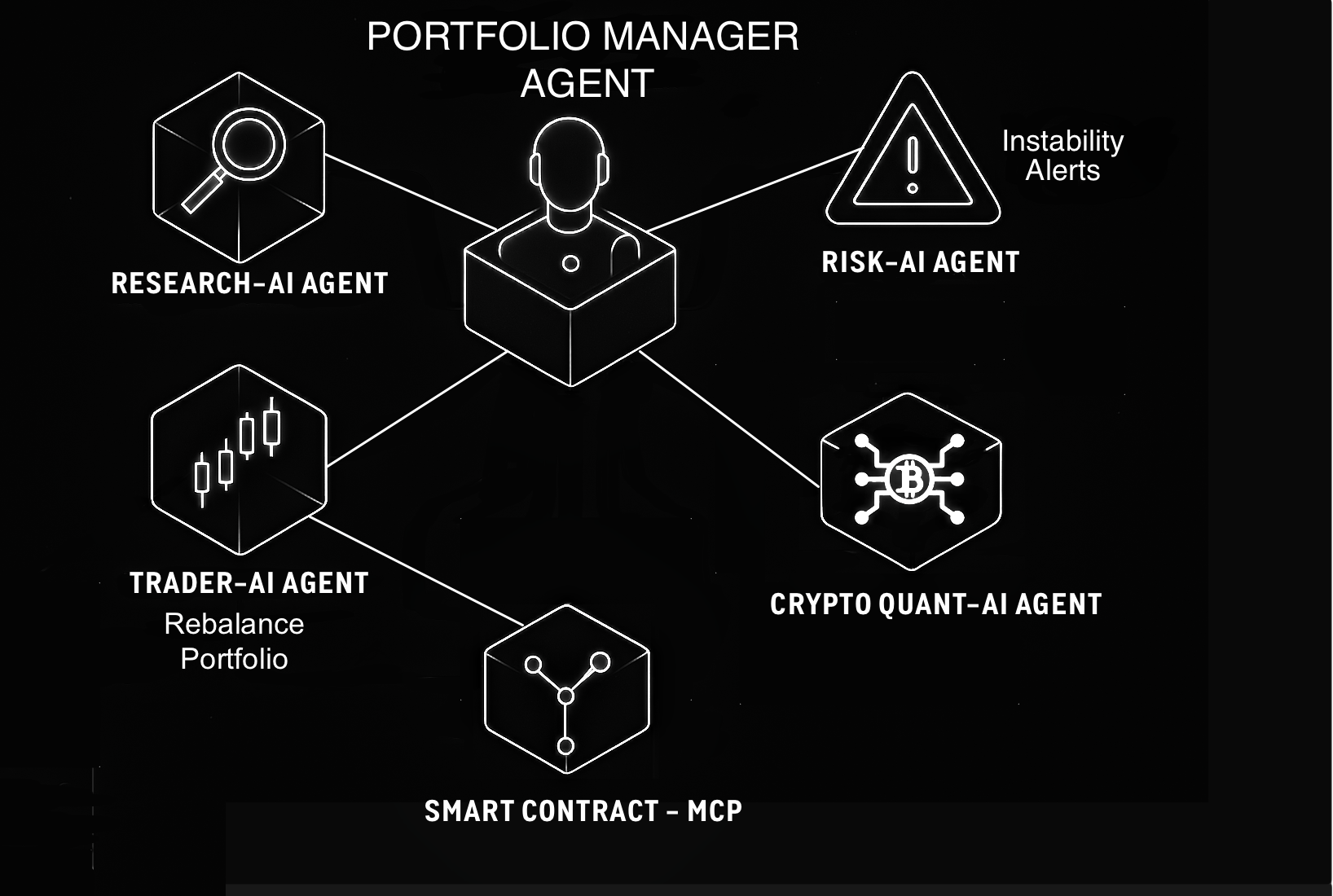

Meet the AI Team

Five specialized AI agents collaborate to handle portfolio strategy, market research, risk management, and trade execution on our crosschain liquidity SmartContract.

- • Allocates capital across assets

- • Ingests insights from research and risk agents

- • Issues rebalance orders to Trader-Agent

- • Does not hold or access funds

- • Analyzes market data, fundamentals, social media & news

- • Scores tokens and provides actionable insights

- • Real-time token performance analysis

- • Top market assets evaluation

- • Calculates real-time VaR, Sharpe Ratio, volatility

- • Alerts for black swan events and hacks

- • Monitors massive selloffs and volatility risks

- • Advises on portfolio stability

- • Executes rebalance instructions from PM-Agent

- • Only interacts with Smart Contract

- • Never handles funds directly

- • Transparent execution

- • Fund custody & asset management

- • 3 public functions (Invest, Withdraw & Rebalance)

- • 8% performance fee on profits only

- • Deployed on Unichain EVM L2

- • Advanced quantitative modeling

- • Cross-chain analytics and insights

- • Find best new opportunities

- • Portfolio optimization algorithms

Cross-Chain DeFi Architecture

The Smart Contract is deployed on Unichain L2 and integrates Uniswap V4, consolidating liquidity from dozens of blockchains into a single, optimized environment. This ensures minimal slippage during rebalancing and consistently low gas fees.

Fast, 1 second block times.

Minimun value lost to MEV.

Stage 1 Rollup.

Addresses liquidity fragmentation by aggregating assets from dozens of blockchains into a single, unified investment environment.

The smart contract manages decentralized custody. It is simple and offers two methods for investors: Invest and Withdraw. Additionally, it provides a Rebalance Portfolio method for the Trader Agent. An 8% performance fee is deducted only from the final profit.

Core DeFi Principles

The foundation of our autonomous cross-chain investment approach

Full Automation

Specialized AI agents operate continuously across multiple blockchains without human intervention

Secure Custody

Smart contracts provide transparent, auditable cross-chain fund management

Separation of Duties

No single agent controls funds, ensuring distributed responsibility across the network

Stablecoin investment

The contract uses stablecoins to manage investments and withdrawals within the protocol, as well as to calculate profits.